I received the following question from a student:

I saw from another study manual and learned that the formula for the bond’s write-up in the t-th year is:

(Ci – Fr) * v ^(n-t+1)

For example, the write up for the 15-th year of a 20 years term bond is: (Ci – Fr) * v ^(20-15+1) = (Ci – Fr) * v ^6

I went through the lessons on your website but could not find this formula. Can you explain what are write-up and write-down of a bond and show the formula for each? Or can you point me to the appropriate lesson on your website so I can go back and review?

My response was:

You are correct. I don’t explicitly cover this formula in the lesson (I think I do in a video solution but I’m not 100% positive). It really is just an extension of the idea from loan amortization. Remember if we borrow L and make a level payment of R for n periods we have:

and the principal repaid at time t is

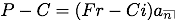

For bonds, we make level payments and a ballon payment of C at time n. Start with the Premium/Discount formula for bonds:

If we isolate the a-angle-n on the right side (like in the basic loan amortization) we have:

If P > C then we have a premium bond. In other words, each coupon payment (Fr) is greater than the interest due (Ci). Because the bond investor receives a coupon larger than the interest due he must pay a premium for the bond. P – C is the amount of the premium and it “funded” by the difference in each coupon minus interest due (Fr – Ci). So you can treat as the basic loan case where L = P – C and R = Fr – Ci. So the amount of principal repaid (or in this case amount of write-down) for the t-th payment is

You can do the same analysis for a discount bond (coupon payment is less than interest due) and will get the amount of the write-up is

Student Questions

I received the following question from a student:

Would you always want to buy a bond at discount? What is the advantage of buying at premium?

Here is my response:

Discount does not imply you got a “good deal”. Consider these three bonds:

Bond A: 10-year annual bond with $1000 par amount, 5% coupons and a yield of 5%.

Bond B: 10-year annual bond with $1000 par amount, 0% coupons and a yield of 5%.

Bond C: 10-year annual bond with $1000 par amount, 20% coupons and a yield of 5%.

The price of each bond is:

Bond A: 50 a-angle-10 + 1000v^10 = 1000 (priced at par)

Bond B: 1000v^10 = 613.91 (discount bond)

Bond C: 200 a-angle-10 + 1000v^10 = 2158.26 (premium bond)

Which of these bonds is the “best deal”? From a yield perspective they are equivalent – all three bonds earn 5%. So which bond should an investor buy? Well it depends on her cash flow needs.

Bond A pays annual coupons of $1000 x .05 = $50

Bond B does not pay an annual coupon

Bond C pays annual coupons of $1000 x .20 = $200

Maybe the investor doesn’t need any cash inflow over the next 10 years and is worried that she wouldn’t be able to reinvest any cash inflows at more than 5%. In this case, she would choose bond B. Maybe she needs annual cash flow of $50, then she would choose A. Maybe she needs a larger annual cash flow of $200 then she would choose C.

If she bought B, then she bought the bond at a “discount” but her coupon payments were less than bond A’s (in fact her coupons are 0). So that is why she got the discount on the purchase price.

If she bought C, she paid a “premium” but her coupon payments were much larger to account for that premium. To receive those larger coupons she needed to pay more.

Student Questions

I received the following question:

Can you explain what yield rate is, how it is used, etc. in relation to annual effective rate and nominal rate of interest?

Here is my response:

“annual effective rate” is the TYPE of interest rate (as opposed to something like the nominal annual rate convertible monthly).

“yield rate” is the interest rate earned by an investor. To find this you set up an equation of value setting the time of value of her cash inflows to the time value of her cash outflows. The yield rate can be expressed as an annual effective rate, nominal annual rate convertible monthly, a force of interest, etc.

Student Questions

I received the following question:

When we are trying to find the value at time 4 for a $1000 cash flow at time 2, don’t we need to discount back to time 0 by dividing by 1.10, and then multiply by 1.2 since we are dealing with simple interest? Maybe I am not looking at it right, but I didn’t think that we could go directly from time 2 to time 4?

Here is my response:

There is a difference between saying

(1) interest is credited using a simple interest rate of 20% per year for t >= 4

and

(2) interest is credited at a force of interest

I know that is confusing since it appears that (2) implies simple interest of 20%, but really if it says “interest is credited using simple interest” in words then you treat every payment as if that happens at time 0. Really we should just say that simple interest doesn’t have an accumulation function. Instead you just take the amount multiply by the simple interest rate and that is the interest for every period.

Student Questions

I had the following question from a student:

I am having some trouble understanding this question. I know how they solve the question but I am trying to solve it using the accumulation factor. In the solutions, they solve for the accumulation factor by taking an integral from n-10 of the force of interest. Using the trick you showed in your seminar, I found a(t) to be 1+t/8. Could you explain how the accumulation factor is used when it comes to these types of questions. The whole idea of continuous payments seems to bother me.

Here was my response:

Student Questions

A student on the AO asked about how to study for preliminary exams. Here is my response.

Student Questions

Here is a picture of how the BAII Plus TVM (time value of money) worksheet works:

Student Questions

Lots of students have trouble counting the number of payments. I recently answered this question for a student. Here is what I wrote:

What if I told you there was a payment at times 1, 2 and 3. How many payments is that? 3 of course, but what we really did (3-0)/1 = 3. So if there are payments at times 3, 6, 9, and 12 then we have (12 – 0) / 3 = 4 payments. If we have payments at times 20, 25, 30, 35, and 40 then we have (40 – 15) / 5 = 5 payments. If we have payments at times 22, 28, 34, …, 112 then we have (112 – 16) / 6 = 16 payments.

Student Questions

If you are trying to email me your solution to a problem then please use the following notation style:

If the problem only has one interest rate then you can leave off the “@ 5%” part.

Student Questions